Property Tax Rate Union City Ca . california city documentary and property transfer tax rates governance: To find a tax rate, select the tax year. residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. our mapping and data website, union city public viewer, provides information on properties, city services, and local features. property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. A message from henry c. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Enter just one of the following choices and click the corresponding search button: how to pay online.

from www.todocanada.ca

to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. california city documentary and property transfer tax rates governance: our mapping and data website, union city public viewer, provides information on properties, city services, and local features. property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. A message from henry c. how to pay online. Enter just one of the following choices and click the corresponding search button: residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. To find a tax rate, select the tax year.

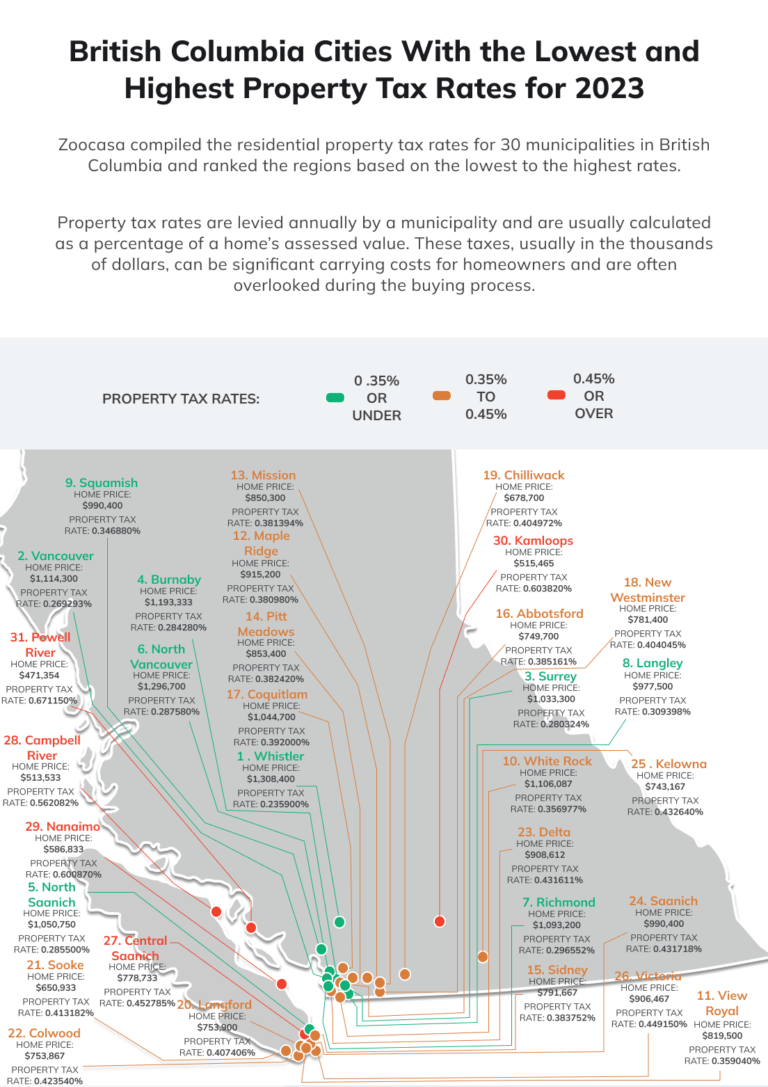

6038 in Kamloops and 2693 in Vancouver For a 1M House Property Tax

Property Tax Rate Union City Ca california city documentary and property transfer tax rates governance: california city documentary and property transfer tax rates governance: to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Enter just one of the following choices and click the corresponding search button: To find a tax rate, select the tax year. property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. A message from henry c. how to pay online. residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. our mapping and data website, union city public viewer, provides information on properties, city services, and local features.

From napavalleyregister.com

New California city sales tax rates take effect on April 1 Business Property Tax Rate Union City Ca A message from henry c. how to pay online. To find a tax rate, select the tax year. residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. california city documentary and property transfer tax rates governance: property taxes. Property Tax Rate Union City Ca.

From cenqoxru.blob.core.windows.net

Which States Have Low Property Tax Rates at James Riley blog Property Tax Rate Union City Ca residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. our mapping and data website, union city public viewer, provides information on properties, city services, and local features. property taxes in union city usually range between $4,250 and $12,050, with. Property Tax Rate Union City Ca.

From lao.ca.gov

Understanding California’s Property Taxes Property Tax Rate Union City Ca california city documentary and property transfer tax rates governance: Enter just one of the following choices and click the corresponding search button: To find a tax rate, select the tax year. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. . Property Tax Rate Union City Ca.

From edebdolorita.pages.dev

California State Sales Tax 2024 Rate Reina Dominga Property Tax Rate Union City Ca to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. california city documentary and property transfer tax rates governance: property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. how to. Property Tax Rate Union City Ca.

From www.momentumvirtualtours.com

Denver Property Tax Rates Momentum 360 Tax Rates 2023 Property Tax Rate Union City Ca property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. A message from henry c. how to pay online. california city documentary and property transfer tax rates governance: residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of. Property Tax Rate Union City Ca.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate Union City Ca Enter just one of the following choices and click the corresponding search button: A message from henry c. how to pay online. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. residents of alameda county, where the median home value. Property Tax Rate Union City Ca.

From cexoiake.blob.core.windows.net

What Is The Property Tax Rate In Indianapolis at Janice Alldredge blog Property Tax Rate Union City Ca To find a tax rate, select the tax year. how to pay online. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. our mapping and data website, union city public viewer, provides information on properties, city services, and local features.. Property Tax Rate Union City Ca.

From moco360.media

How would MoCo’s proposed property tax hike stack up against other Property Tax Rate Union City Ca california city documentary and property transfer tax rates governance: property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. our mapping and data website, union city public viewer, provides information on properties, city services, and local features. To find a tax rate, select the tax year. residents. Property Tax Rate Union City Ca.

From activerain.com

2019 Property Tax Rates Mecklenburg And Union Counties Property Tax Rate Union City Ca property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. A message from henry c. Enter just one of the following choices. Property Tax Rate Union City Ca.

From alexirish.com

Who Pays the Least Property Tax in Ontario? The Answer may Surprise You Property Tax Rate Union City Ca to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. our mapping and data website, union city public viewer, provides information on properties, city services, and local features. how to pay online. A message from henry c. Enter just one of. Property Tax Rate Union City Ca.

From outliermedia.org

Detroiters’ 2023 property taxes are going up. Blame (mostly) inflation. Property Tax Rate Union City Ca property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. california city documentary and property transfer tax rates governance: A message from. Property Tax Rate Union City Ca.

From lao.ca.gov

Understanding California’s Property Taxes Property Tax Rate Union City Ca residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. to calculate the exact amount of property tax you will owe. Property Tax Rate Union City Ca.

From www.linkedin.com

2022 property tax rates across 35 Ontario municipalities Property Tax Rate Union City Ca residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. Enter just one of the following choices and click the corresponding search button: california city documentary and property transfer tax rates governance: to calculate the exact amount of property tax. Property Tax Rate Union City Ca.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rate Union City Ca to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. A message from henry c. how to pay online. property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. our mapping. Property Tax Rate Union City Ca.

From exogijrog.blob.core.windows.net

Property Tax Rate Sonoma Ca at Lynn Nguyen blog Property Tax Rate Union City Ca A message from henry c. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. how to pay online. residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a. Property Tax Rate Union City Ca.

From www.reddit.com

Toronto Is Planning To Increase Property Tax Rates By 10.5 r Property Tax Rate Union City Ca to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. california city documentary and property transfer tax rates governance: how to pay online. To find a tax rate, select the tax year. property taxes in union city usually range between. Property Tax Rate Union City Ca.

From texasscorecard.com

Commentary How Property Taxes Work Texas Scorecard Property Tax Rate Union City Ca our mapping and data website, union city public viewer, provides information on properties, city services, and local features. To find a tax rate, select the tax year. Enter just one of the following choices and click the corresponding search button: residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate. Property Tax Rate Union City Ca.

From 2025weeklymonthlyplanner.pages.dev

California Tax Rates For 2025 A Comprehensive Guide 2025 Property Tax Rate Union City Ca Enter just one of the following choices and click the corresponding search button: property taxes in union city usually range between $4,250 and $12,050, with the average tax bill sitting at $8,298. how to pay online. residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for. Property Tax Rate Union City Ca.